How To Evaluate A Company's Value

For example a competitor has profits of 100000 and sells for 500000. A business valuation calculator helps buyers and sellers determine a rough estimate of a businesss value.

Types Of Financial Models Educba Financial Modeling Financial Analysis Financial Management

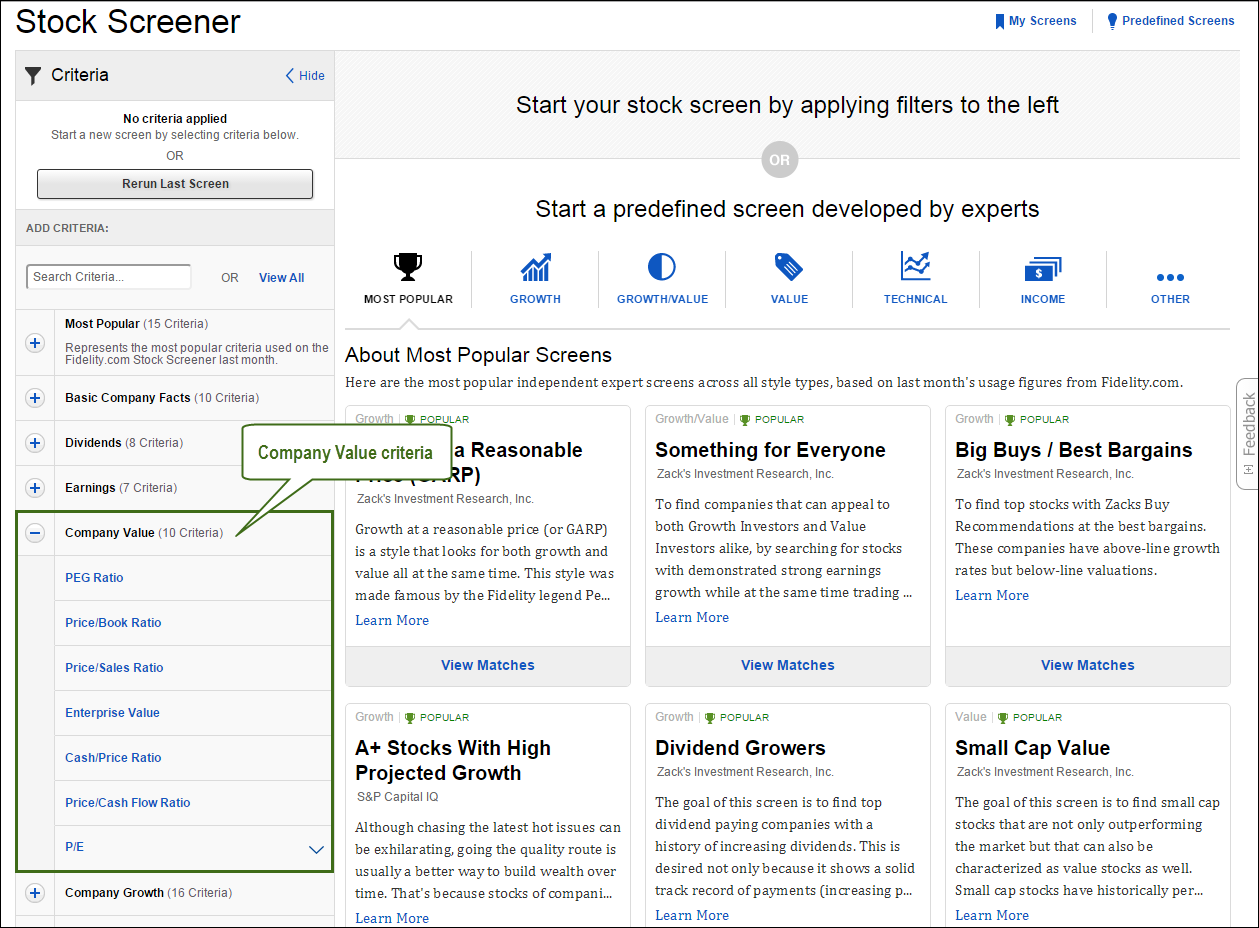

See multiples and ratios.

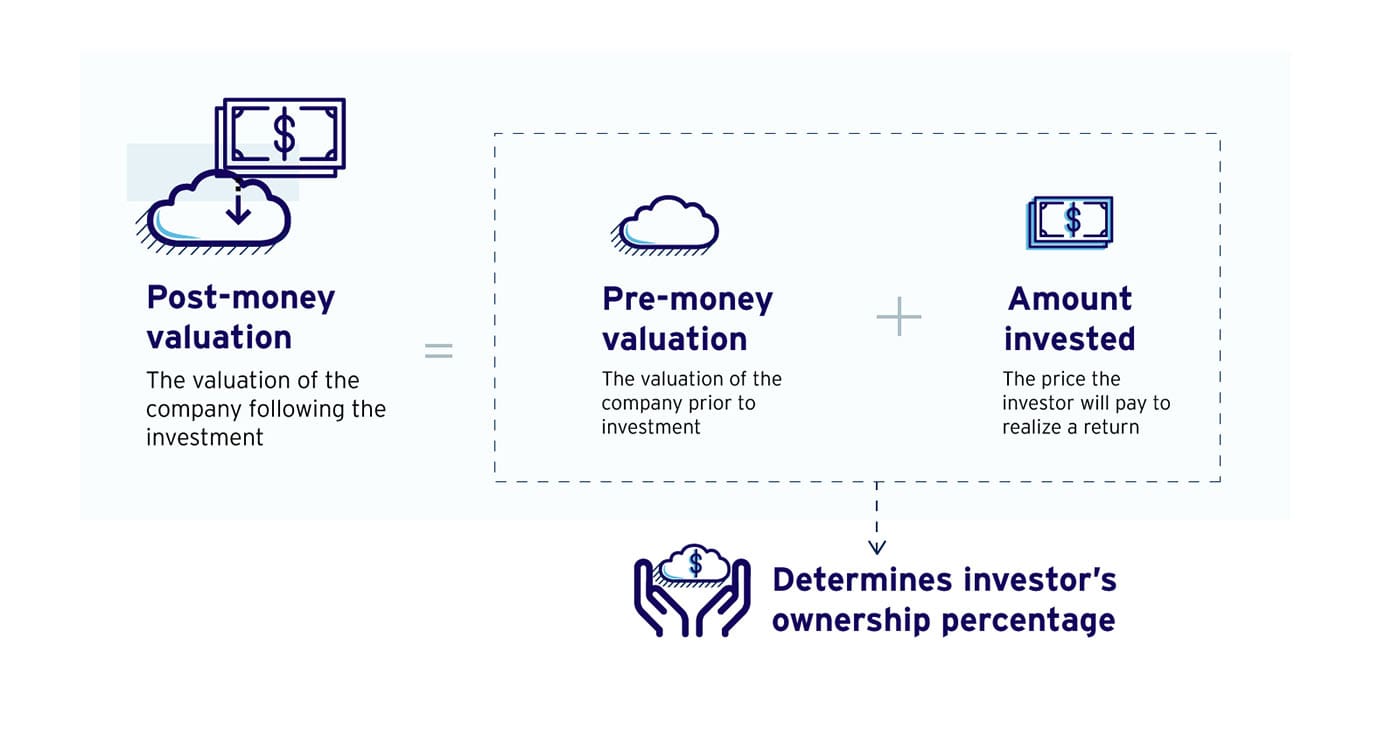

How to evaluate a company's value. Evaluating your values statement. From this the investor can determine that the value of the business. For public companies valuation is referred to as market capitalization which well discuss below where the value of the company equals the total number of outstanding shares multiplied by the price of the shares.

A valuator determines the companys value by reviewing past results and forecasted cash flow or earnings. There are numerous ways to evaluate company value. There are a lot of ways to illustrate how your company applies its core values.

Essentially youre looking to see if the company has enough money to cover their expenses. Evaluate your values using Figure 1 below. To figure out the value of the business an investor analyses other risk investments that have the same kind of cash flows.

Compare the companys profits to the sale prices of other similar companies that have sold recently. Post value-related stories to your blog every week or month. Discover why PitchBook is the only tool you need for your next private company valuation.

The multiple is similar to using a discounted cash flow or capitalization rate used by top business valuation appraisers and top analysts. Discover why PitchBook is the only tool you need for your next private company valuation. You should also be checking to see if the companys short-term debts will cause them to exhaust their cash before the years end.

Send out customer or employee stories in your newsletter. Two of the most common business valuation formulas begin with either annual sales or annual profits also known as seller discretionary earnings multiplied by an industry multiple. Weve just simplified it for small business owners.

Learn how professionals value a business. For a more personalized and in depth business valuation we provide a free business evaluation and consultation for local business owners who are thinking about selling their business. The market capitalization is defined as a companys stock value multiplied by its total number of shares outstanding.

They may also assess how reasonable the the companys projections are. The most reliable and straightforward way to determine a companys market value is to calculate what is called its market capitalization which represents the total value of all shares outstanding. The best place to start when evaluating a company is looking for liquidity on the balance sheet in cash form.

Asset approach which calculates all the assets and liabilities of a company in its valuation and can be seen as assets minus liabilities. This guide provides examples including comparable company analysis discounted cash flow analysis and the first Chicago method. Valuation is usually forward-looking Leung says.

Some of the most popular methods include. See multiples and ratios. The investor now recognizes a 4 million Treasury bond that returns about 10 annually or 400000.

It relies purely on the financials. DCF analysis uses future free cash flow projections and discounts them to arrive at a present value estimate which is used to evaluate the potential for investment In laymans terms you are basically trying to figure out what the current value is of the cash the company will generate in the future. Mainos See the value of a company before and after a round of funding.

3 techniques for Private Company Valuation - learn how to value a business even if its private and with limited information. This is a 5x profit multiple. Because your values are a key foundational element to your company and strategic plan you want to be doubly sure theyre the right ones.

So if the owners company has profits of 300000 then the 5x multiple can be used to derive a market-based valuation of 1500000. Post positive feedback you receive from customers on your website or social platforms. Mainos See the value of a company before and after a round of funding.

Book Value This valuation method is the most straightforward. A buyer isnt buying what the business earned in the past but what it will earn in the future. There are three ways to evaluate a companys value.

Pin On Understanding Market Capitalization Ev

How To Calculate The Valuation Of A Company

The Art And Science Of Company Valuations Infographic Startup Funding Business Valuation Start Up Business

Vrio Analysis Business Analysis Analysis Business Quotes

Company Valuation Ratios Fidelity

Company Values The Definitive Guide With Top Examples

Evaluate Your Strategic Positioning Innovation Management Marketing Strategy Social Media Business Analysis

Company Values The Definitive Guide With Top Examples

Company Culture Quotes Culture Quotes Company Culture Quotes Company Culture

Disney Corporate Culture Cast Core Values Tips From Pros Core Values Leadership Corporate Culture

How Is Npv Calculated Financial Investments Investing Definitions

How To Value A Technology Business

20 Balance Sheet Ratios Every Investor Must Know Bookkeeping Business Financial Statement Analysis Financial Ratio

What Is Porter S Value Chain Model And Why It Matters In Business Fourweekmba Operating Model Secondary Activities P S Of Marketing

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At Meant To Be Intangible Asset Credit Card Statement

Profitable Sweet Spot For Startups Business Analysis Business Model Canvas Business Strategy

Business Valuation How Investors Determine The Value Of Your Business Entrepreneur S Toolkit

What Does Pe Ratio And Book Value Tell About A Company 4 5 Min Read Enterprise Value Value Investing Value Stocks

Posting Komentar untuk "How To Evaluate A Company's Value"